Fight the Arrogance #GiveItBack #oklaed

This may not be a surprise to those who know me, but apparently I’m arrogant. That’s what Oklahoma Finance Secretary Preston Doerflinger thinks of those of us who believe that continuing to cut taxes in the face of massive state revenue failures is bad public policy. I guess that’s why he went after new Tulsa Regional Chamber chairman Jeff Dunn in two separate Facebook posts yesterday. Here’s how the Tulsa World covered it:

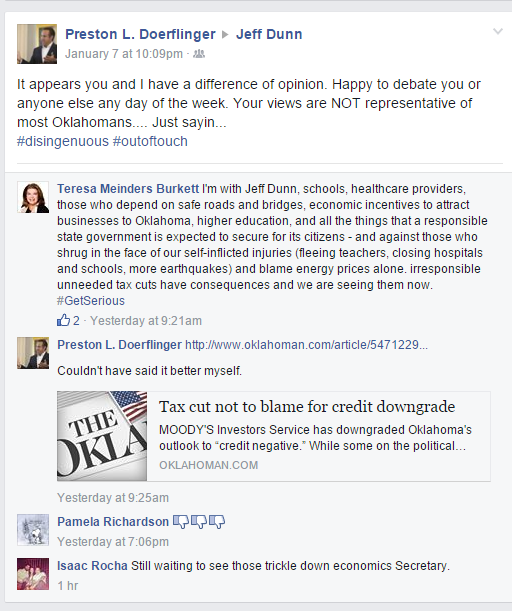

Finance Secretary Preston Doerflinger, a Tulsa resident, was responding to Chairman Jeff Dunn’s blunt criticism of “a senior Cabinet official” for defending the 0.25 percent reduction in the state income-tax rate that went into effect last week, even as state agencies were told to trim spending by 3 percent because of a general revenue failure.

Although Dunn did not name the official when he made the comments during a speech to the chamber Thursday, it was understood to be Doerflinger because of recent comments he has made.

The two Facebook posts — one on Doerflinger’s own page and one on Dunn’s — used the hashtags “really?,” “outoftouch,” “ohthearrogance” and “disingenious,” apparently to describe Dunn.

What this tells me is that those of us who’ve taken to social media to express our outrage are making a difference. Why else would a member of the governor’s cabinet slam a Chamber leader on Facebook? Remember how tight Governor Fallin has been with big business? This seems to indicate a rift.

It could also mean that politicians facing re-election feel vulnerable. I thought the comments further down on Dunn’s Facebook page were also enlightening.

One of Dunn’s friends commented:

I’m with Jeff Dunn, schools, healthcare providers, those who depend on safe roads and bridges, economic incentives to attract businesses to Oklahoma, higher education, and all the things that a responsible state government is expected to secure for its citizens – and against those who shrug in the face of our self-inflicted injuries (fleeing teachers, closing hospitals and schools, more earthquakes) and blame energy prices alone. Irresponsible unneeded tax cuts have consequences and we are seeing them now.#GetSerious

Doerflinger’s response was to link to an editorial in yesterday’s Oklahoman, and add the endorsement, Couldn’t have said it better myself. Really? Could you have tried?

Yet to hear some critics, you’d think the $901 million shortfall facing legislators this year is all the result of tax policy. Rep. Scott Inman of Del City, who leads the House Democratic caucus, typified such thinking in a recent Facebook post. Noting that Oklahoma’s income tax rate dropped from 5.25 percent to 5 percent on Jan. 1, Inman argued that the income tax cut only “reduced the amount of revenue growth that could have come into the general fund” to spend on things like education, health care and public safety.

He dismissed as “laughable” the idea that allowing Oklahomans to keep more of their own money could contribute to economic activity and growth.

We’ll grant that the timing of this income tax cut isn’t ideal. Previous tax cuts came from surplus collections during economic booms.

But for too many on the political left, tax increases are the only answer to a downturn. They simply can’t imagine that it might be good for government to ever streamline or pare any activity.

Is anyone calling for an increase? No, we’re saying don’t cut taxes when you can’t fund the basic government services that you’ve promised to the people of the state.

Remember, it was as cloistered group from the governor’s office and the legislature who wrote the budget at the last minute in May. It was this small group that built the budget based on revenue projections that weren’t realistic in the first place. They plugged holes with one-time funds. They did nothing to address the predictable, preventable position we’re in now.

I would think a private sector CFO would be fired for striking out that egregiously.

But those of us who saw it coming and can’t contain our anger now…we’re the bad guys. Here’s more of Doerflinger, from the World:

“In light of Jeff Dunn’s comments at the Tulsa Chamber meeting … let there be no doubt I am always going to be in favor of the hardworking, tax paying citizens of this state being able to keep more of THEIR money. Modest, incremental tax reductions are not the problem and it is disingenuous to suggest otherwise. The arrogance of those who would suggest to YOU, the tax paying citizens of this state that you should not be able to keep more of your hard earned dollar astounds me.”

The Oklahoma Policy Institute has covered this thoroughly. They even have created an online calculator to illustrate how much we save by letting the .25% tax cut happen. I’ve run some numbers below to show you just how blessed you are to have leaders such as these in place.

| Taxable Income | Married | Children | Savings |

| $35,000 | Yes | 2 | $9 |

| $35,000 | No | 2 | $20 |

| $75,000 | Yes | 2 | $109 |

| $75,000 | No | 2 | $118 |

| $125,000 | Yes | 2 | $224 |

| $125,000 | No | 2 | $226 |

| $200,000 | Yes | 2 | $388 |

| $500,000 | Yes | 2 | $1,040 |

If you’re a teacher, and you’re single raising kids, your tax cut is about $20. The OPI placed the median tax cut at $29. For that amount, the state is losing $147 million in revenue. If your taxable income is $500,000, and your line in the sand is $1,040, then you’re a huge part of the problem.

We have a $901 million dollar hole. Our leaders have chosen not to reverse a policy decision that would have filled about one-sixth of that hole. It’s simply foolish.

At this point, I want to see a show of hands. If you’re a state representative or senator, and you still think that keeping the most recent .25 percent state tax cut was a good idea, knowing everything we know now, we need to know who you are. You need to be challenged in your primary. If you escape that, you need a hard challenge in November.

Our state is in a serious economic and policy crisis. We need people in our statehouse who are, for lack of a better term, statesmen and stateswomen stately. When someone like that speaks his mind, we don’t need the state’s largest newspaper mocking him. For those who continue supporting tax cuts at any cost, please don’t call yourself a public education supporter. You’re simply not.

I’m fortunate to have two good incomes in my household. My tax cut is in the three-digit range. I’ll be donating it to the Mid-Del Public Schools Foundation. I’ll also be making donations to candidates who can serve this state with reality in mind.

With all that in mind, tell me which of these people is arrogant. I’ll make it multiple choice, so we can standardize our responses.

- The kindergarten teacher who doesn’t like having 32 students in a classroom

- The student who doesn’t like having fewer course options from which to choose

- The principal who just wants all the computers in the lab to work at the same time, just once, dammit

- The superintendent who has a running list of deferred building maintenance that he hopes will hold until the next bond election

- A state cabinet official who thinks this is an opportunity

There’s no correct answer; it’s only an field-test item try-out interrogative opportunity.

As I said above, I’ll be donating my tax cut back to my school district. You can too. If you’re not sure the best way to do so, contact a principal, or a teacher, or the PTA. They’ll have suggestions. You can even give a little extra to one of the high school booster clubs. It still helps the kids, and that’s what matters.

If you’re a teacher, and your tax cut is somewhere between $9 and $29, you’ve probably already donated at least that amount in-kind with your unpaid days and personally-bought classroom supplies.

On top of that, find us some real pro-education candidates. And donate to them.

“…it’s only an item tryout” — hilarious! I have already given mine back. I gave it to the Oklahoma Policy Institute, which has been trying to inform policy makers of the consequences of theses tax policies for several years now.

LikeLiked by 1 person

Oklahoma has never put education at the top of its list and look where it has gotten us

We rank high in all the areas that we shouldn’t

As long as our governor and legislatures are not concerned about improving.our state and attracting businesses that would help our state we’re screwed.

The oil business has been good for Oklahomans coffers but when the price goes south our kids loose out. We need other businesses to help us grow and not be so dependent on the oil industry

LikeLiked by 2 people

Here are some facts about Mr. Doerflinger’s pay. It would appear to me he has already taken his tax cut, and that of several thousand teachers.

2015 Total Pay $159,040.94

2014 Total Pay $137,465.77

2013 Total Pay $108,249.94

2012 Total Pay $104,130.53

Data source: http://ok.gov/okaa/

LikeLiked by 2 people

AMEN!📢

Sent from my iPhone

>

LikeLike

Yes, yes and YES! I retired in June 2015 because I was tired of the fight. I really didn’t think it could get any worse. I was wrong. Keep fighting the good fight. They won, the beat me down. And now will only let me make 15,000 to go back to work in my profession. One that is experiencing a critical teacher shortage. No thank you.

LikeLiked by 2 people

Reblogged this on marvels Agents Of Ed.

LikeLike