The Budget in One Word: Catastrophe

Maybe it was a coincidence. Three things were happening at about the same time, around 1:00 this afternoon.

- The State Board of Education was preparing for a special meeting with one agenda item: addressing the three percent cut to state aid.

- Several curious parties – including quite a few district superintendents – were arriving to hear the discussion about these cuts first hand.

- The credit union in the Sequoyah Building – which is directly to the south of the Hodge Building (which houses the SDE) – was being robbed.

I’m pretty sure this was not an elaborate scheme to stabilize school funding. In any case, the article listed the suspect as 6’2” and wearing a red-hooded sweatshirt. Maybe it was this guy:

The timing made for extra tension and security inside the Hodge Building, and that says quite a bit. We were already on edge because Superintendent Hofmeister was there to announce a $46.7 million funding cut:

State Board of Education makes required 3% budget cut to preK-12 in wake of revenue failure

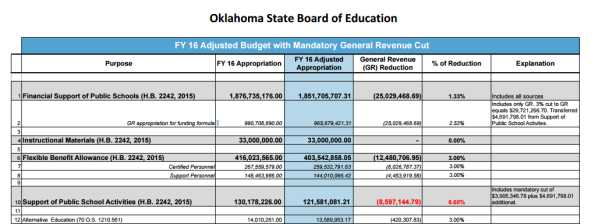

OKLAHOMA CITY (Jan. 7, 2016) — In the wake of a revenue failure affecting all of Oklahoma state government, the State Board of Education today approved a required 3-percent reduction in a $46.7 million funding cut for preK-12 public education. The reduction impacts the remaining six months of Fiscal Year 2016, which ends June 30.

“There is no denying that this cut poses serious challenges for school districts during a time in which every dollar already is precious, and not all districts will be affected the same way. But the State Board of Education and Oklahoma State Department of Education have addressed the required cuts as fairly and judiciously as possible, while attempting to minimize student impact,” said State Superintendent of Public Instruction Joy Hofmeister.

While the cuts are certain to have a significant effect on Oklahoma’s 550-plus school districts (a figure that includes charters and co-ops), Hofmeister and her fellow board members were able to soften the blow by transferring $4.6 million from the Public School Activities appropriation to the State Aid Funding Formula that provides the bulk of money to school districts.

Each line item in School Activities took a minimum 3-percent cut, which includes such programs as alternative education, Teach for America, the early childhood initiative, Sooner Start and the Oklahoma Arts Institute. Four line items are contributing well above 3 percent to cushion a hit on the funding formula. In addition to the transferal, the board approved a $3.9 million cut in the School Activities appropriation.

After the transferal, the funding formula — also known as Financial Support for Public Schools — takes a $25 million funding cut.

Flexible Benefits Allowance funding to districts will be lessened by $12.4 million, a 3-percent cut.

The cuts will be reflected in the next six monthly payments to school districts.

All in all, the SDE staff did the best they could with the completely predictable, preventable budget collapse that the state dealt them. Three percent became 2.53% because of some funds under the activities budget that they were able to shift.

It is also important to note that state aid to schools comes from two buckets of money. First is what’s known as the HB 1017 fund, which is a dedicated revenue stream created in statute in 1990. At this time, the state hasn’t declared a revenue failure for the 1017 fund. That’s why the top line shows a 1.33% cut to state aid. Keep in mind, however, that this could change.

The easy way out would have been simply cutting each line by three percent. I can assure you that the Board and those of us in the audience appreciated the decision to protect the formula as much as possible. Still, as I look down the spreadsheet, I see some money that is simply wasted. There’s $8 million for ACE Remediation and $4.5 million for testing. In case you’re interested, that’s about the cut to the Flexible Benefit Allowance – you know, our health insurance.

After today’s meeting, I feel two things. First, I’m grateful that Hofmeister’s staff did what they could to soften the blow. Second, I’m furious. Then again, I’ve been that way since late November when it became obvious we’d reach this point.

I don’t know how familiar you are with catastrophe theory. Essentially, the idea is that slight changes to variables add up and move a system from a state of balance to the cusp of disaster.

It can be a miscalculation that eliminates the stable state. It can be happenstance. It can be direct influence from an outside actor. It can be negligence. Eventually, the instability of the system causes a collapse. It seems sudden, but it’s not.

“How did you go broke?” “Two ways. Gradually, then suddenly.” – Ernest Hemingway, The Sun Also Rises

Maybe that image and explanation are too highbrow. Let me try it a different way.

We as a state were certain that we could tax cut our way to prosperity. That’s why we (and I’m using the royal we here) voted for SQ 766. That’s why the Legislature and Governor won’t halt the tax cuts that net average citizens about $30 and cripple critical state programs.

What could possibly go wrong?

It’s also what Malcolm Gladwell would refer to as a tipping point. Then again, not all tipping points are bad. He also explains:

If you want to bring a fundamental change in people’s belief and behavior…you need to create a community around them, where those new beliefs can be practiced and expressed and nurtured.

That’s pretty much what we’ve done with #oklaed over the last three years. As this spring progresses, as we talk to our elected leaders – who may be tempted to throw their hands up and act helpless – we have to remember that they brought us to this tipping point, this catastrophe, this funding disaster. This was a choice that was made gradually, with the outcomes realized suddenly.

Pretending differently is also a choice. Let’s not allow anyone to do so in our presence.

I appreciate the SDE treating Alternative Ed like other programs this time. In every single other revenue failure, the Alt Ed programs have been decimated, leading superintendents to have little faith in that funding. We have seen program quality decline as the budgets declined. So, I was fearful this morning that, once again, Peter (Alt Ed) was going to be robbed to pay Paul (everything else).

For the sake of Oklahoma’s neediest students who populate these programs, I am grateful that Alt Ed received the same 3% cut. I know that Supt. Hofmeister and the SDE staff have been placed in a very difficult situation, and they have done what they could to soften the blow — for ALL students.

LikeLiked by 1 person

This article appears to lean towards a solution of higher taxes to solve the funding shortfall by stating that leaders and voters in the state believe “we could tax cut our way to prosperity.” One must reflect on the opposite as well and look to see if the state could tax it’s way to prosperity.

History has shown, over and over, that a nation or group cannot tax its way to prosperity. There is only so much taxation that can occur before the people refuse to continue paying unrealistic taxes. We must look at history and refer to it in a significant way to understand that taxing never has led to a prosperous nation or group, only to redistribute the wealth of the people.

Another area in the article references the State Aid Funding Formula without actually discussing how this formula works. Without investing significant time to break down how the formula works in detail, it can easily be described as a formula that is used to redistribute money from wealthier school districts to those that are not as wealthy. In short, not all school districts receive money from this formula the same (the author of this article instructs that the funding from this formula provides the bulk of money to school districts so we are talking about significant funds). Districts that are known as donor districts or schools, actually lose money through this formula when things operate in a normal funding fashion. We must now ask, will these “Donor Districts” receive additional funds due to the shortfall or will the formula be changed to avoid this type of activity in this case? I do not have the answer to this question or even have an opinion. I do wonder how this will be addressed as this shortfall has the opportunity to either penalize districts based on community wealth or reward based on the same concept.

I’m certain that many have looked at how to address these issues and expect that even more will let their voices be known.

LikeLike

I also don’t believe that high taxes lead to prosperity. More to the point, though, I find continuing with tax cuts while knowing that the state can’t fund essential programs properly to be foolish.

I could discuss the funding formula in more detail, though. Oklahoma doesn’t actually have donor districts. We do, however, have “chargeables.” The short explanation is that some districts produce a high amount of revenue locally, either through ad valorem collections or gross production tax on oil and gas. This impacts their state aid. There are a few districts with no state aid. Some get nearly all their funding from the state.

In 1998, 59% of school district funding came from the state. In 2014, that had dropped to 48%. Year after year, the state has gradually been abdicating its role in properly funding public education.

LikeLike

You might want to double check on the statement regarding Oklahoma not having any donor districts. You can call a cat a kitty but it’s still a cat. It appears that is what is attempting to be done here with donor districts.

Regardless of what language is being used, everyone is still entitled to know how the cuts and the funding formula will address wealthier district versus districts that are not as wealthy. In the end, wealthier districts will be greater penalized then districts that are not located in wealthy areas or these same wealthy districts will not experience the same level of cuts.

LikeLike

You’re right about there being different levels of cuts. You, and anyone else, can review the calculation sheets:

Click to access B17005W%20%20Formdata%20010816.pdf

LikeLike